Dear Reader,

Lithium price per ton is off 70% from last year's all-time peaks.

There, I said it! But is this your cue to get nervous about lithium and start panic-selling all your lithium and lithium-ion battery positions?

That would be the knee-jerk response from a novice investor, and probably the one that would please members of the crowd. But it’s the exact opposite of what you should be doing.

Let me explain why by starting with the forces driving this collapse. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Over the last several months, automakers have noted what’s been characterized by the media as ‘slowing demand’ in the EV sector.

Headlines like this one, taken from a recent Reuters article, are excellent examples of what I mean:

And yet, if you bother to read just two paragraphs into the actual article, statements like this appear:

Electric vehicle sales are still growing strongly, but that demand is not keeping up with the expectations of carmakers and other companies that have invested billions of dollars in the EV space. Expectations for persistently higher interest rates has led companies to alter plans as they eye 2024 warily.

So how can demand be slowing, while vehicle sales are still ‘growing strongly’?

Panic = Clicks

The answer is: it can’t and isn't. In fact, EV sales are still gobbling up more and more of the broad automotive market, with sales in the US topping 300,000 units for the first time ever in Q3 of this year.

What’s happening is that sales projections aren’t being met. And this is causing panic to cascade from the boardroom, to the institutional shareholders, to the retail shareholders like you and me.

And all of this is compounded and magnified to the fullest degree by the time things reach the most basic commodities supporting the EV revolution – namely, lithium.

Combine that with short-term overproduction, particularly in the energy storage sector, and the price collapses.

But almost all of these panic sellers will regret cutting and running when they did… Because instead of taking note of the readily apparent clues all around them, they chose to listen to the pundits whose primary concern was getting that all-important click.

You see, claiming that lithium is all finished and that we’re moving on to something else would be akin to claiming that oil was done back in the late 1920s, when overproduction and fluctuating vehicle sales also caused a price implosion.

Global oil consumption as not slowed at all. In fact, it's been growing ever since.

But as long as there is human civilization, progress, and economic trends, analysts will attempt to plant the seeds of future ‘I told you sos’, by making big claims about even bigger shifts in the way civilization operates.

Want To Appear On A 'Quotes That Aged Badly' List?

Unfortunately for the lithium haterade chuggers, time is not on their side.

In the coming decade, car buyers across the world are going to be left with less and less of a choice about driving electric vehicles.

That’s not a prediction. It’s a fact already set in stone by mandates in places from Asia to North America.

Norway is set to start banning ICE vehicle sales in 2025, with most of the European continent following suit by the middle of the next decade.

Our own president has stated in no uncertain terms that he wants to see EVs account for 50% of vehicle sales by 2030, and we’re not off pace to achieve that goal.

A year ago EVs represented 6.1% of auto sales in the US. Q2 of this year tallied 7.2%, and Q3 followed with 7.9%.

Does that sound like an industry past its prime?

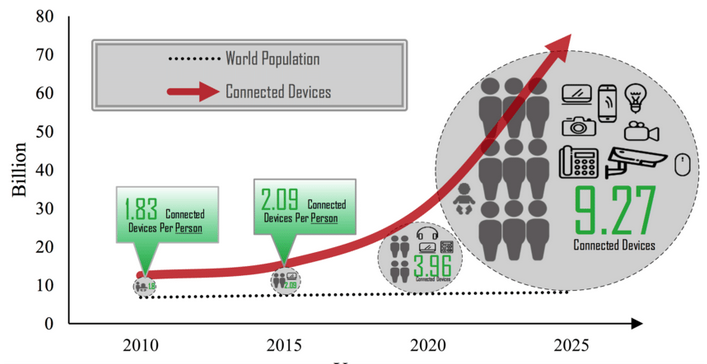

Now switch gears entirely and look at another major driver of lithium demand – wireless device sales.

Here’s where we stand on that front:

We’re actually in the midst of a ‘hockey stick’ pattern for wireless device sales growth, which means commensurate increases in lithium demand from that sector.

That trend will also not abate any time soon, as wireless devices, on top of being addicting, also have an average shelf-life of between 2-3 years.

Now let’s move on to another, already mentioned major component of lithium consumption: energy storage.

Reading these headlines one could be forgiven for assuming that that was on the decline too, and yet:

Again, we’re in a period of rapid growth, approaching a period of even more rapid growth, and it’s all predicated on lithium supply.

Put all that together, and here’s where we stand, right now, in terms of lithium demand versus lithium production:

When viewed alongside the last few months’ trend in lithium prices, there is only one rational conclusion: buy now.

There's Blood In The Streets… What's Your Next Move?

Lithium, whether our politics or personal sensibilities like it or not, is here to stay for a while, and will continue to play an increasingly important role in the electrification of our societies.

It’s imperfect, it’s not easy to find, and it leaves much to be desired when it comes to environmental concerns, but neither was oil when it first became our primary energy storage medium.

Make no mistake about it, lithium, with its versatility and ability to be recharged from any powersource – something no gas tank could ever claim – represents a paradigm-shifting leap ahead.

Look, I know it’s an argument that I shouldn’t have to make. If you’re reading this, chances are you already own multiple devices that need the stuff to operate. So if you're looking for proof that lithium is a vital resrouce, your search can begin and end within the confines of your own home.

What I can do is point you in the direction of the best way to play this.

It's Lithium Extraction Technology… It's Cheap. It's Clean. It's Scalable

You see, with lithium prices depressed – and now projected to stay that way until at least the middle of next year – now is the time to strike.

You can buy any major lithium producer or miner and probably do reasonably well, as they’re all depressed right along with the underlying commodity… Or you could make a play with the potential to really change things.

There is a lithium technology company that I’ve been following for a while now, which I believe could be the best lithium pure-play trading on the public markets today.

This company doesn’t mine lithium. Instead, it uses a unique process to extract it from the unlikeliest source imaginable.

The technology is in its advanced testing phases right now. When it scales up, it will revolutionize the lithium production industry.

The company behind it is young, small, and oversold at the moment… And that’s exactly where a profit-minded speculator wants to be.

I recently published a video presentation on the topic. It’s quick, entertaining, and explains everything in detail.

Only a limited number of my readers have seen it so far. And again, shares are about as cheap as they’re ever going to be right now… so don’t miss the bus.

Get instant access, right here.

Fortune favors the bold,

Alex Koyfman

His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.